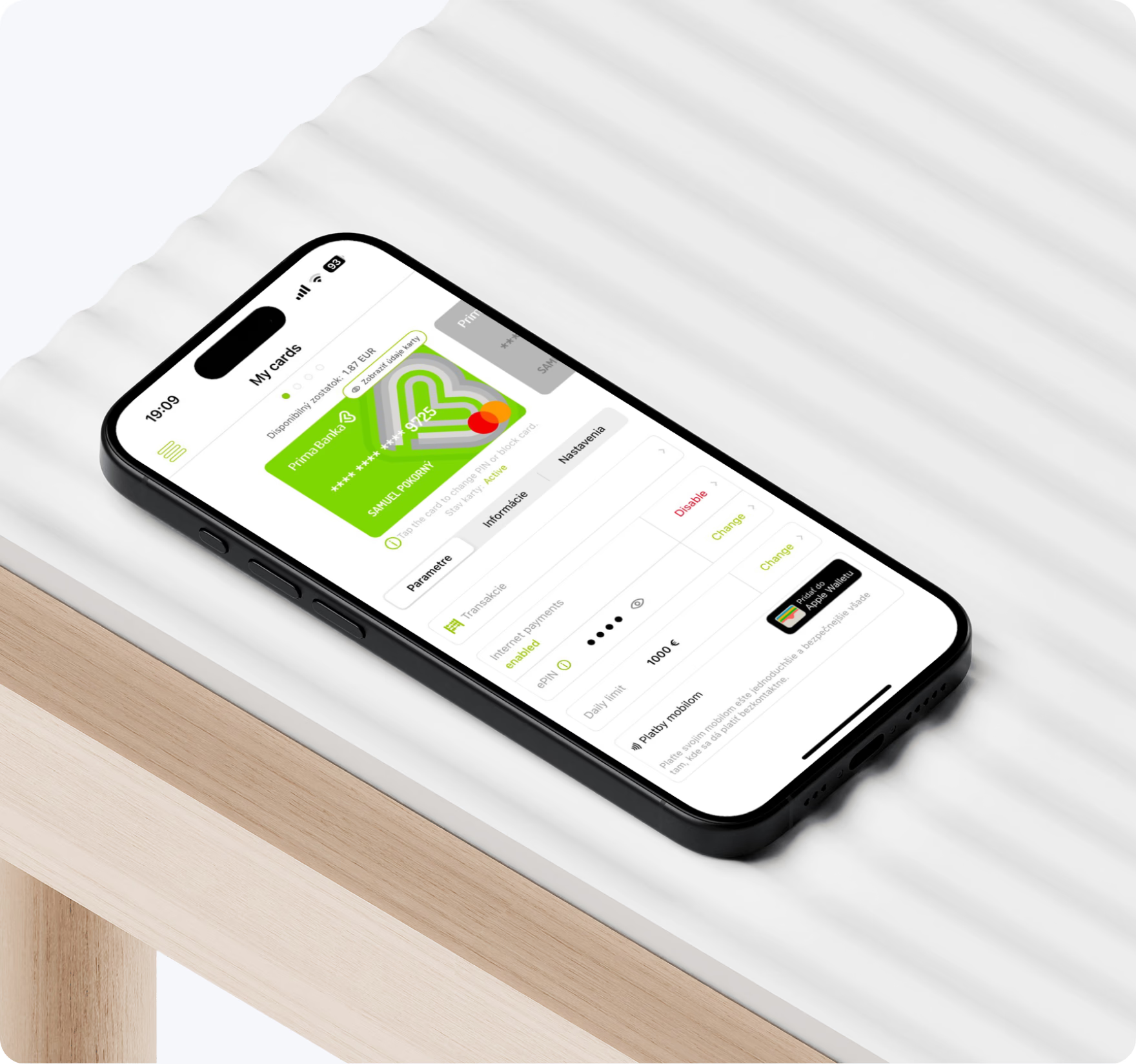

We transformed Prima Banka’s digital platform, enabling users to open bank accounts online, verify identity with Face & ID recognition, and manage finances effortlessly. With a seamless user experience, secure transactions, and compliance-driven features, banking is now faster, safer, and smarter than ever.

Key achievements:

More than 360 000 users and growing

4.8 star rating on respective stores

10+ years of cooperation

Services:

Development

Support & Maintenance

Segment:

Finances

ChallengeS WE SOLVED

Seamless Digital Onboarding

Traditional bank account opening is time-consuming and requires in-person visits. We tackled this by implementing a fully online account opening process with Face & ID verification, allowing customers to verify their identity securely in minutes.

Security & Compliance

Banking apps must meet strict security and regulatory requirements. We integrated top-tier encryption, fraud detection, and biometric authentication to ensure a safe and compliant banking experience.

User-Friendly Banking Experience

Customers expect a fast, intuitive, and hassle-free digital banking platform. We designed a clean, modern interface that simplifies daily transactions, account management, and customer interactions while ensuring ease of use across all devices.

Deliveries

Full-Scale Mobile App Development

We developed a native, secure and high-performance banking application that allows users to manage their finances effortlessly. The app provides a seamless experience for online account opening, fund transfers, and real-time transaction tracking, ensuring customers can access their banking services anytime, anywhere.

Secure Backend & API Integration

We integrated with Prima Banka’s core banking system to enable real-time data access and seamless transactions. By implementing fraud prevention mechanisms, biometric authentication, and encryption protocols, we ensured a highly secure and compliant digital banking environment.

Ongoing Support & Maintenance

Together with Prima Banka, we continuously refine and enhance the platform to meet evolving customer needs and industry standards. Through regular updates, security enhancements, and performance optimizations, we ensure that the banking experience remains fast, secure, and future-ready.